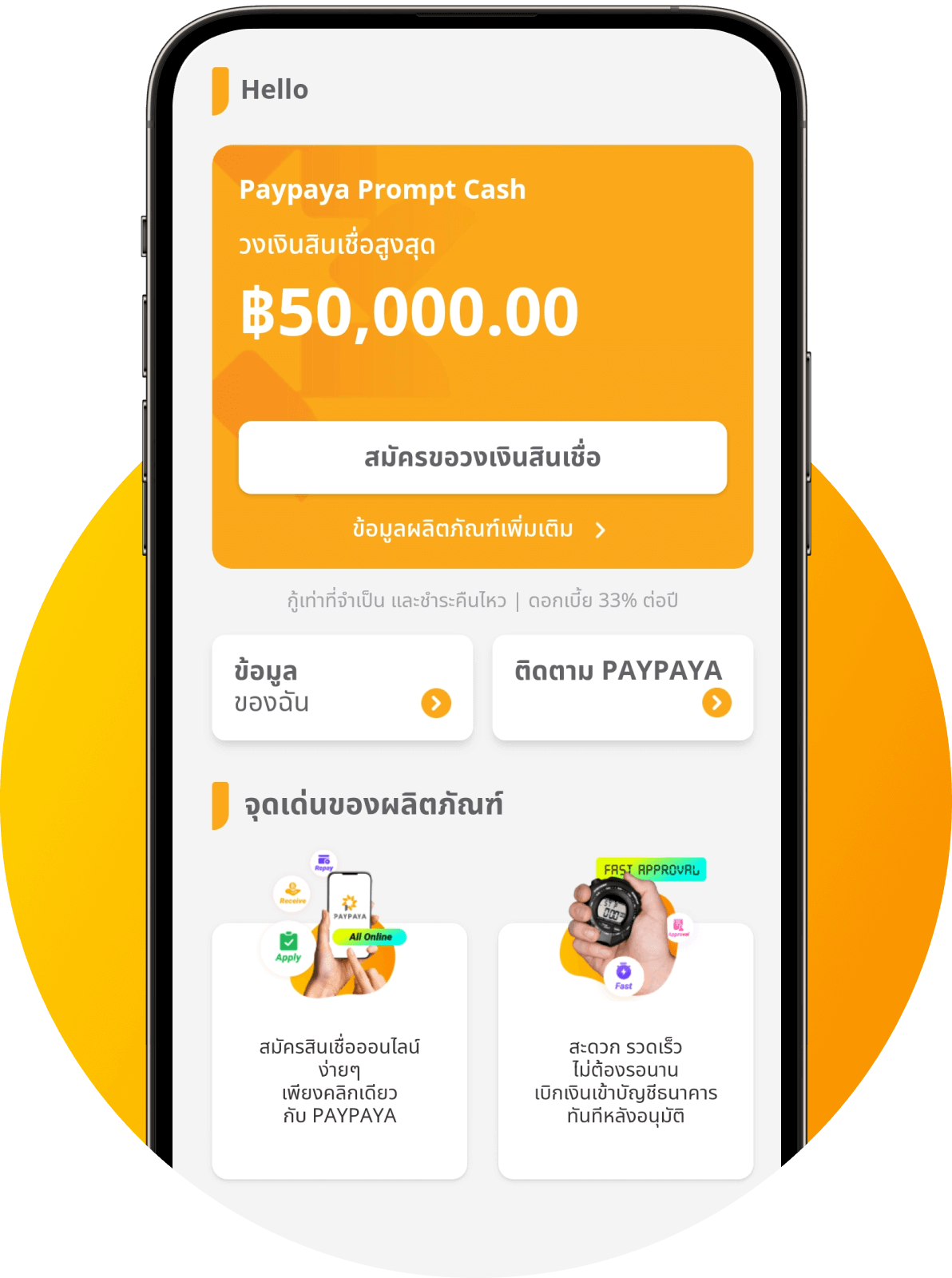

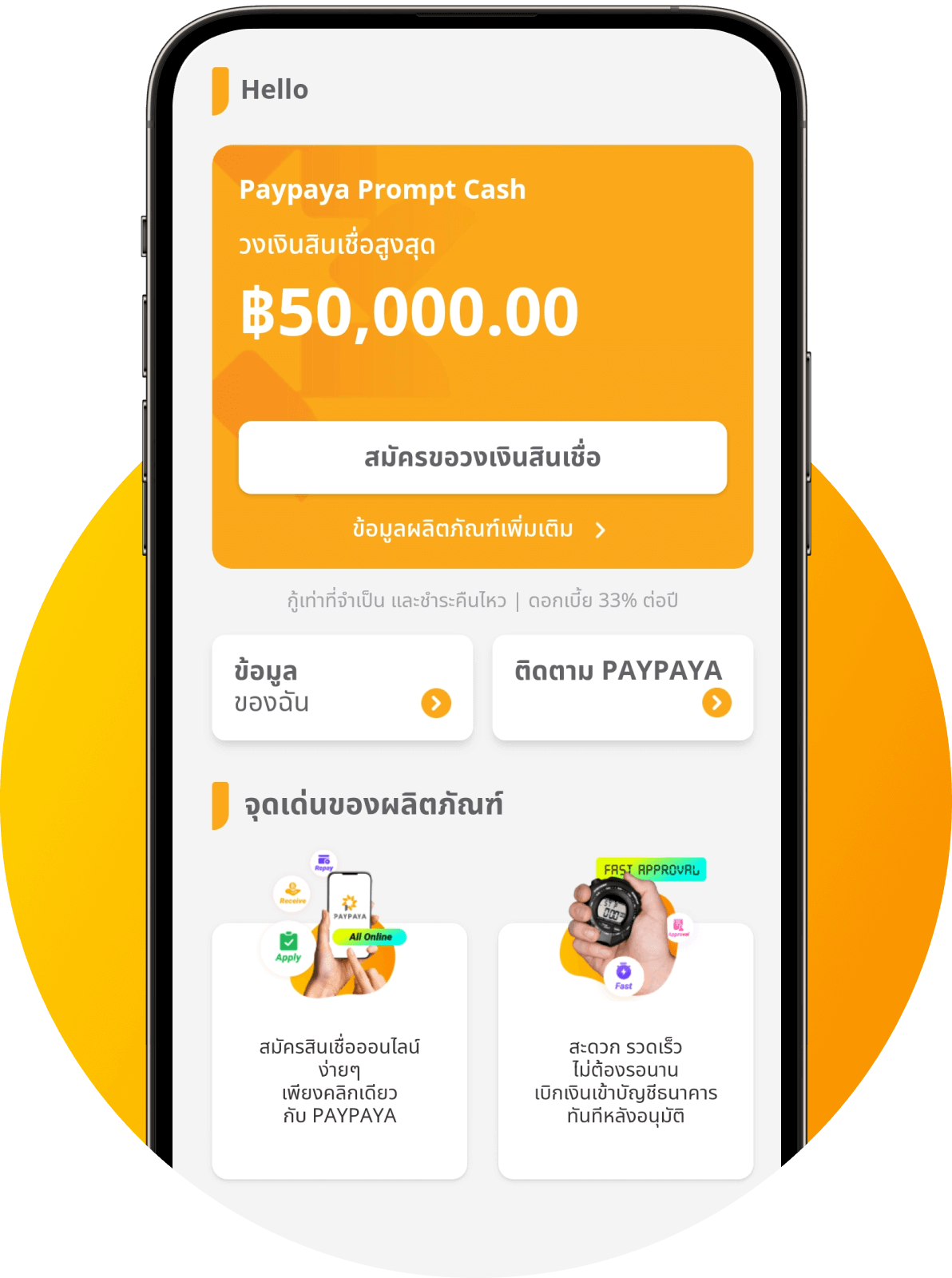

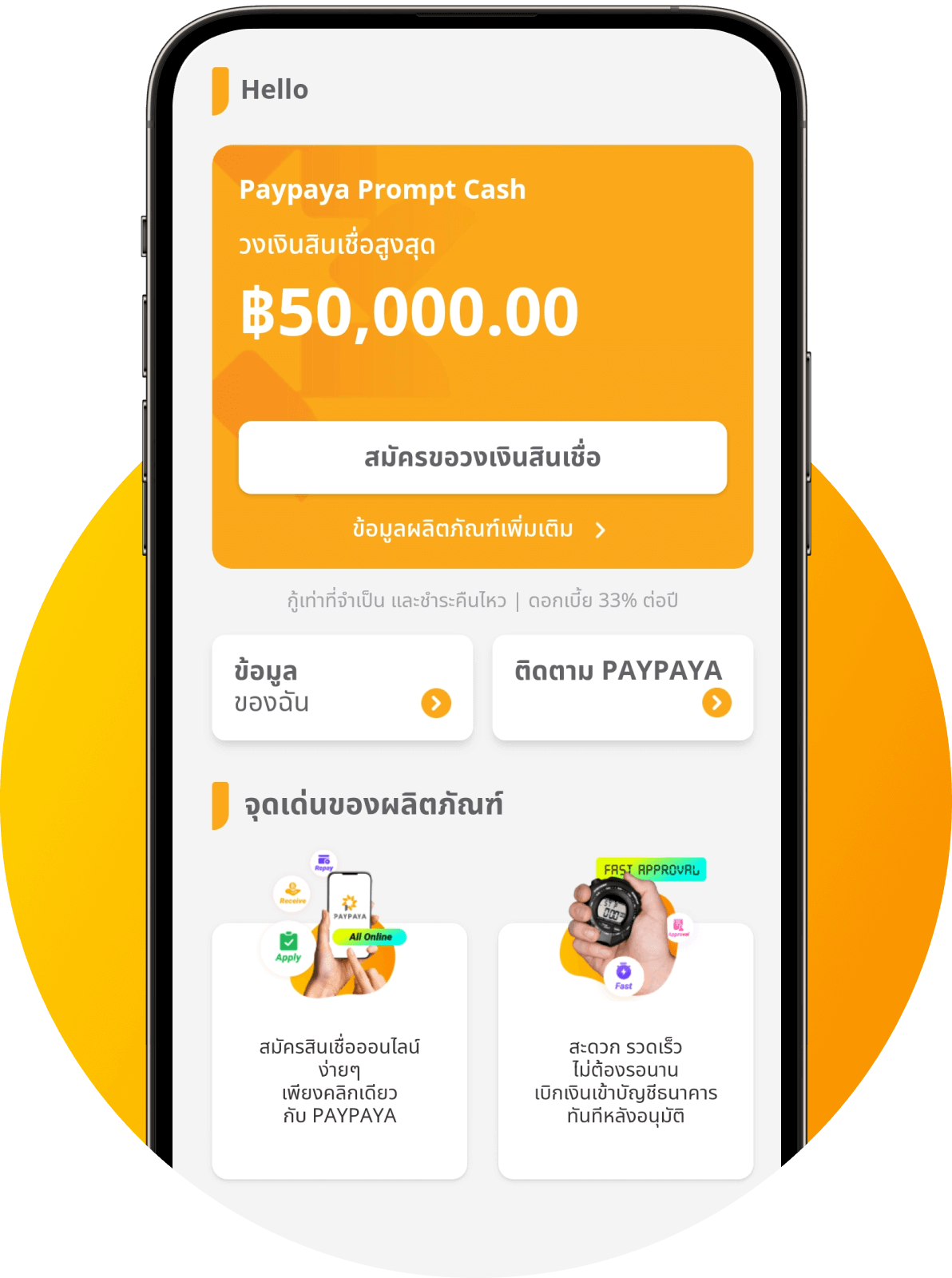

Enter the Paypaya application and tap “Apply for a credit limit.”

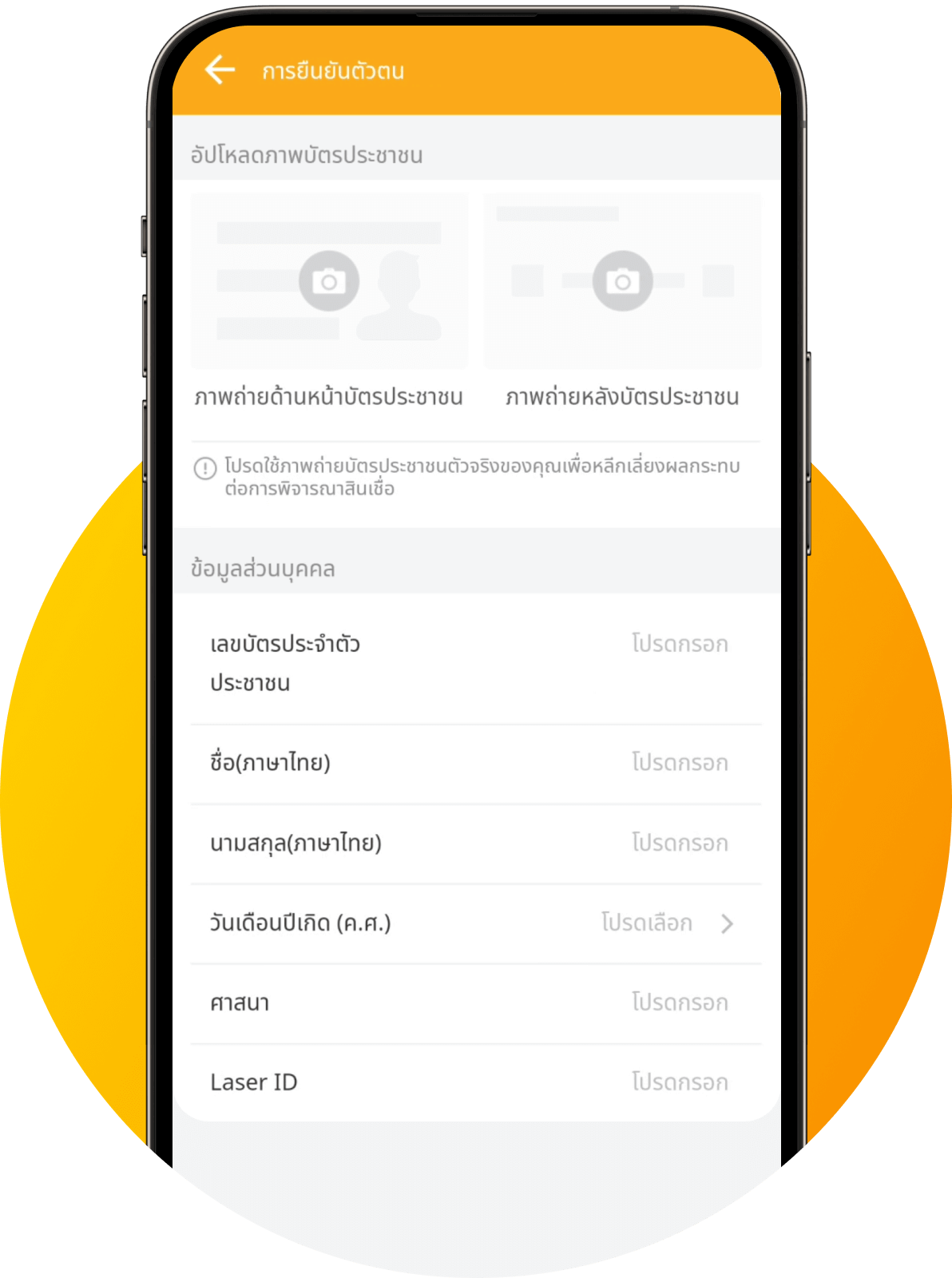

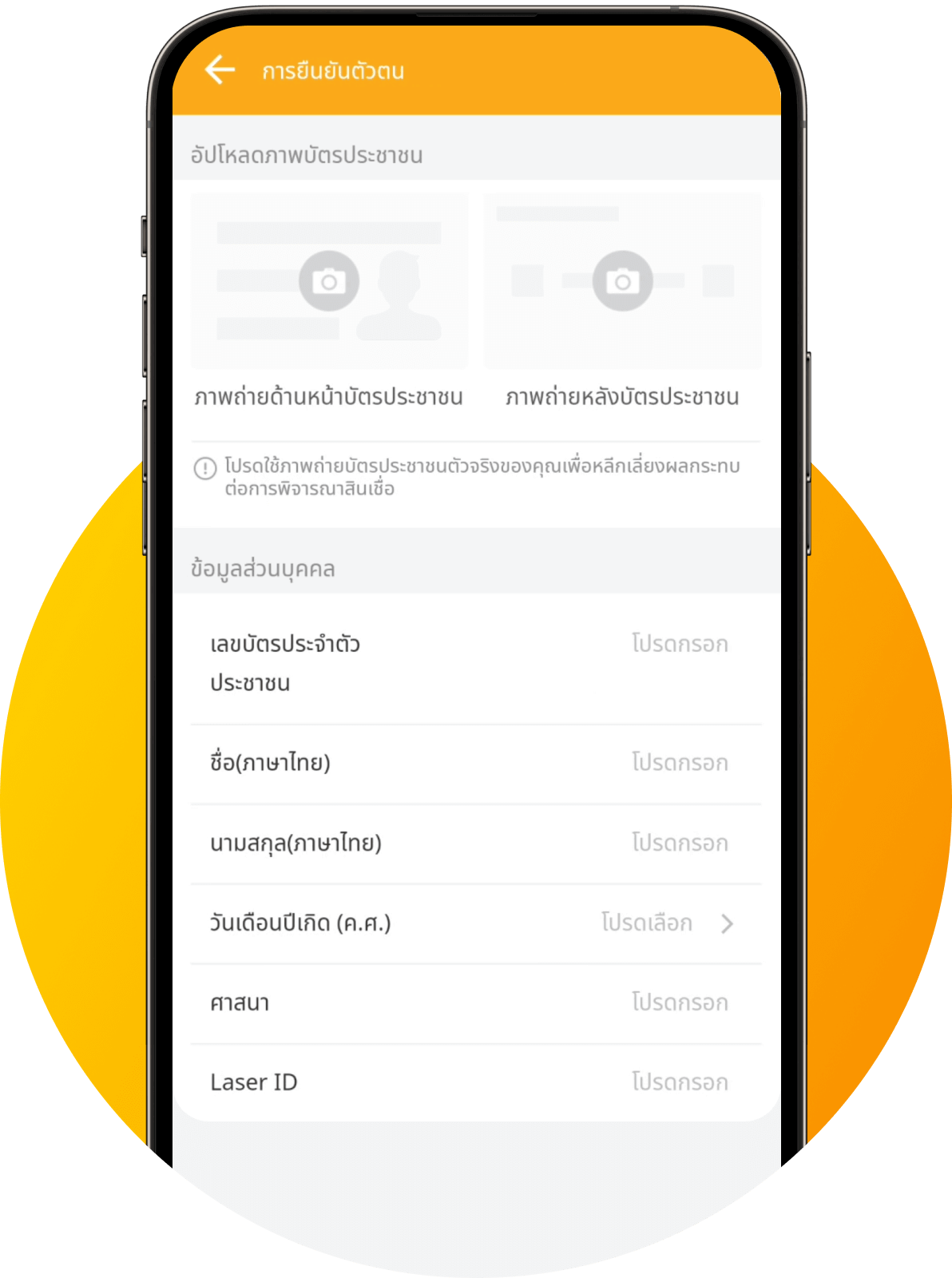

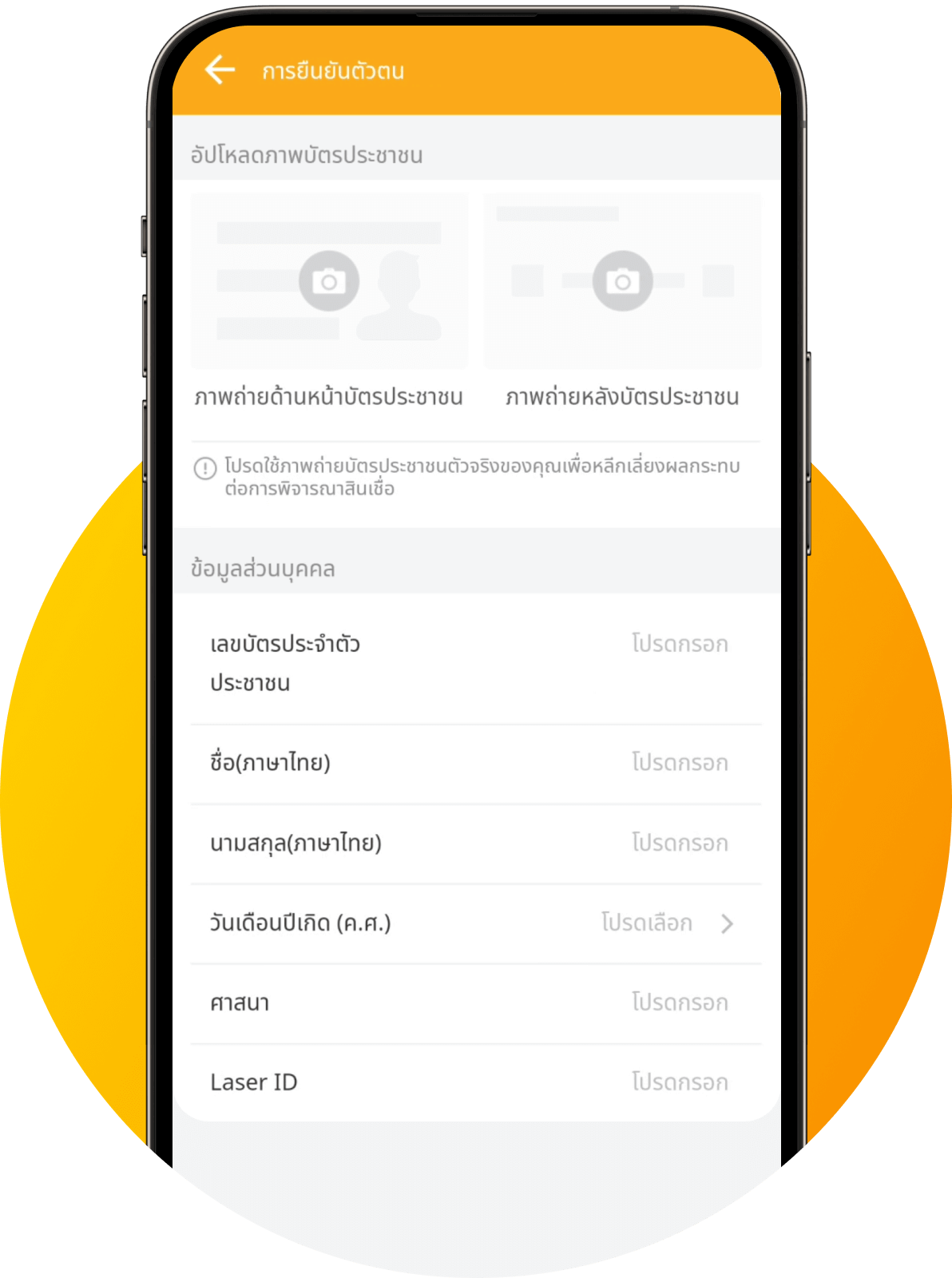

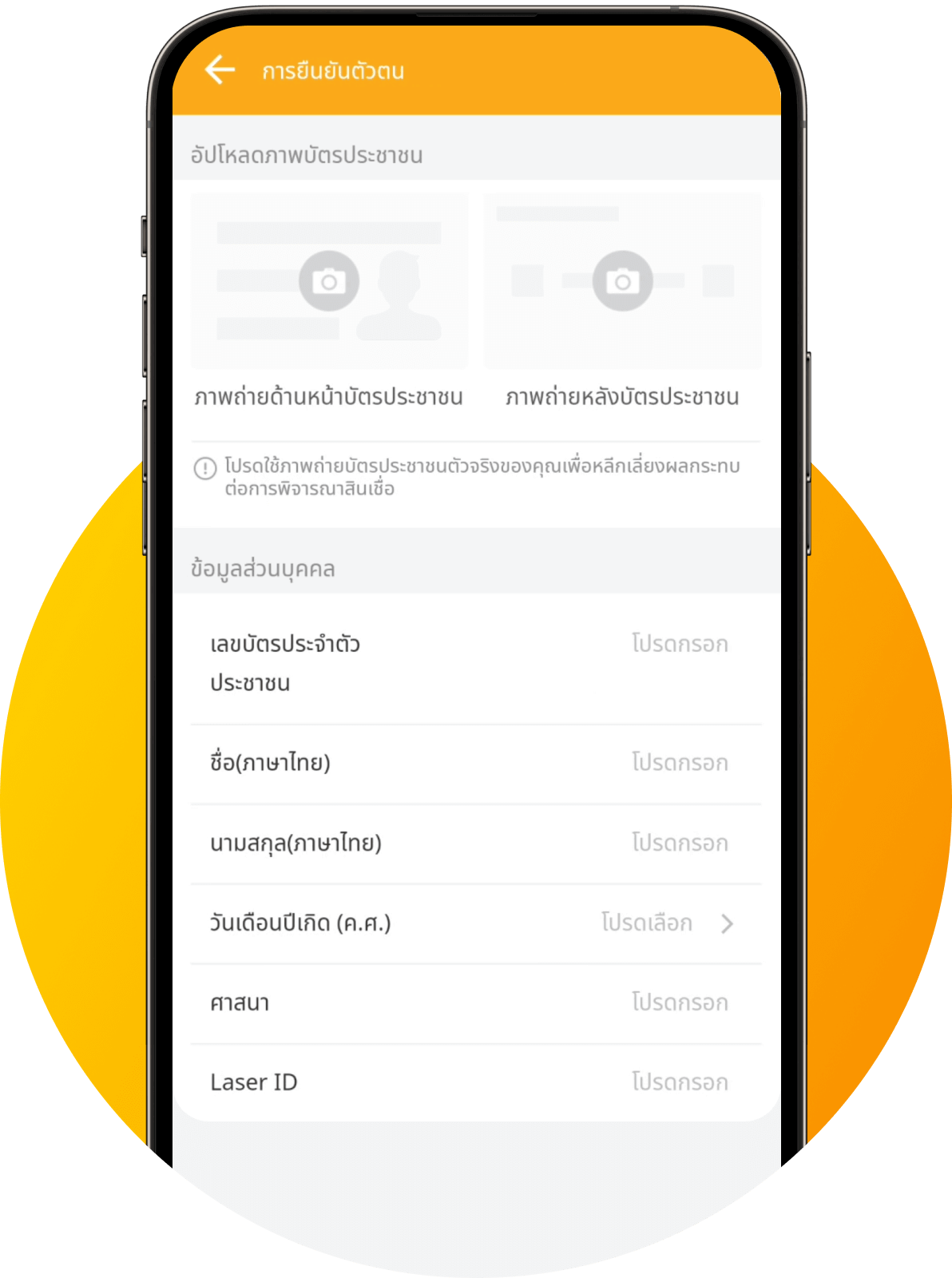

Upload your ID card and fill in your personal information accurately.

Once your application is submitted, you will know the result instantly.

Enter the Paypaya application and tap “Cash Withdrawal.”

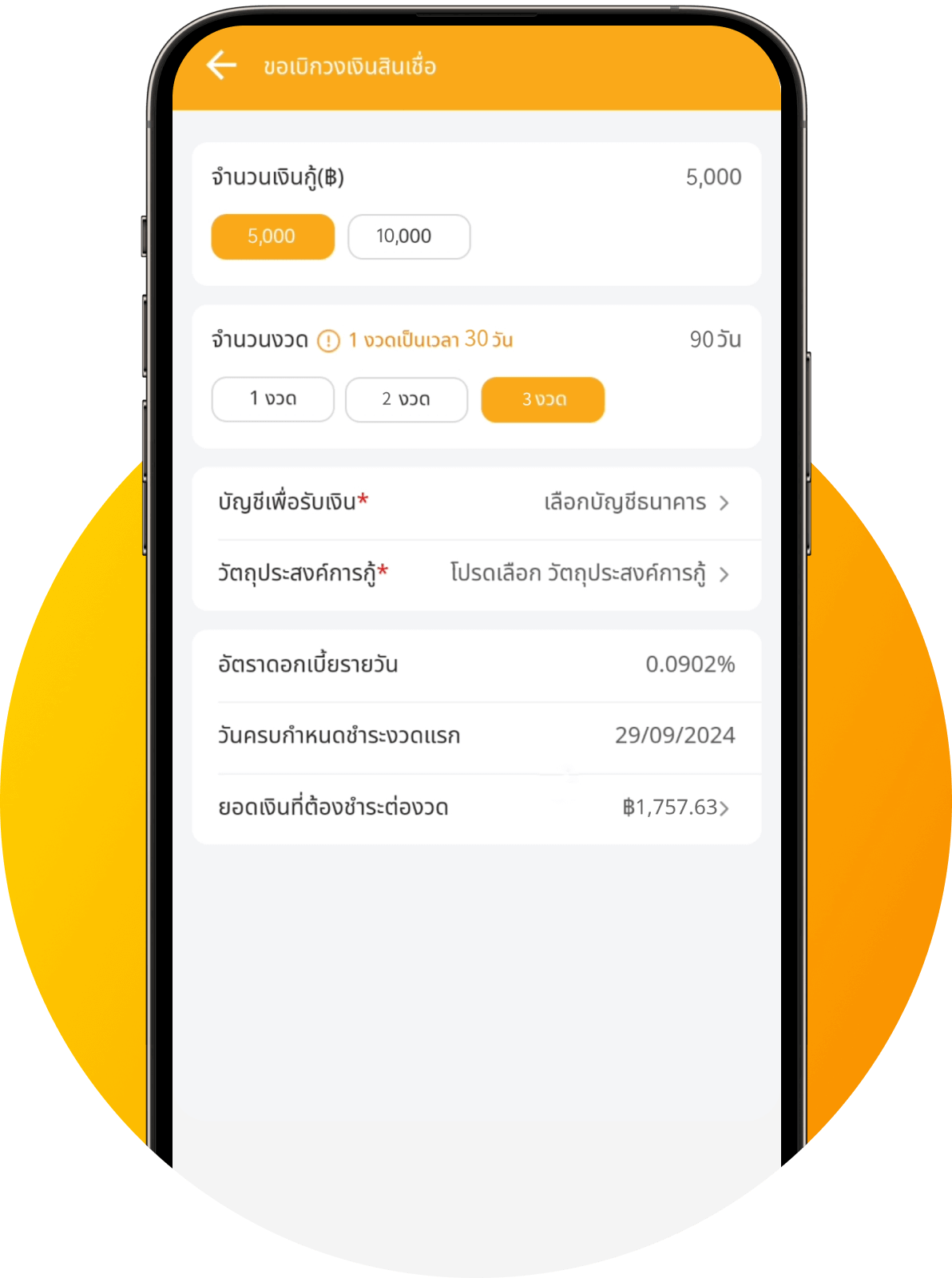

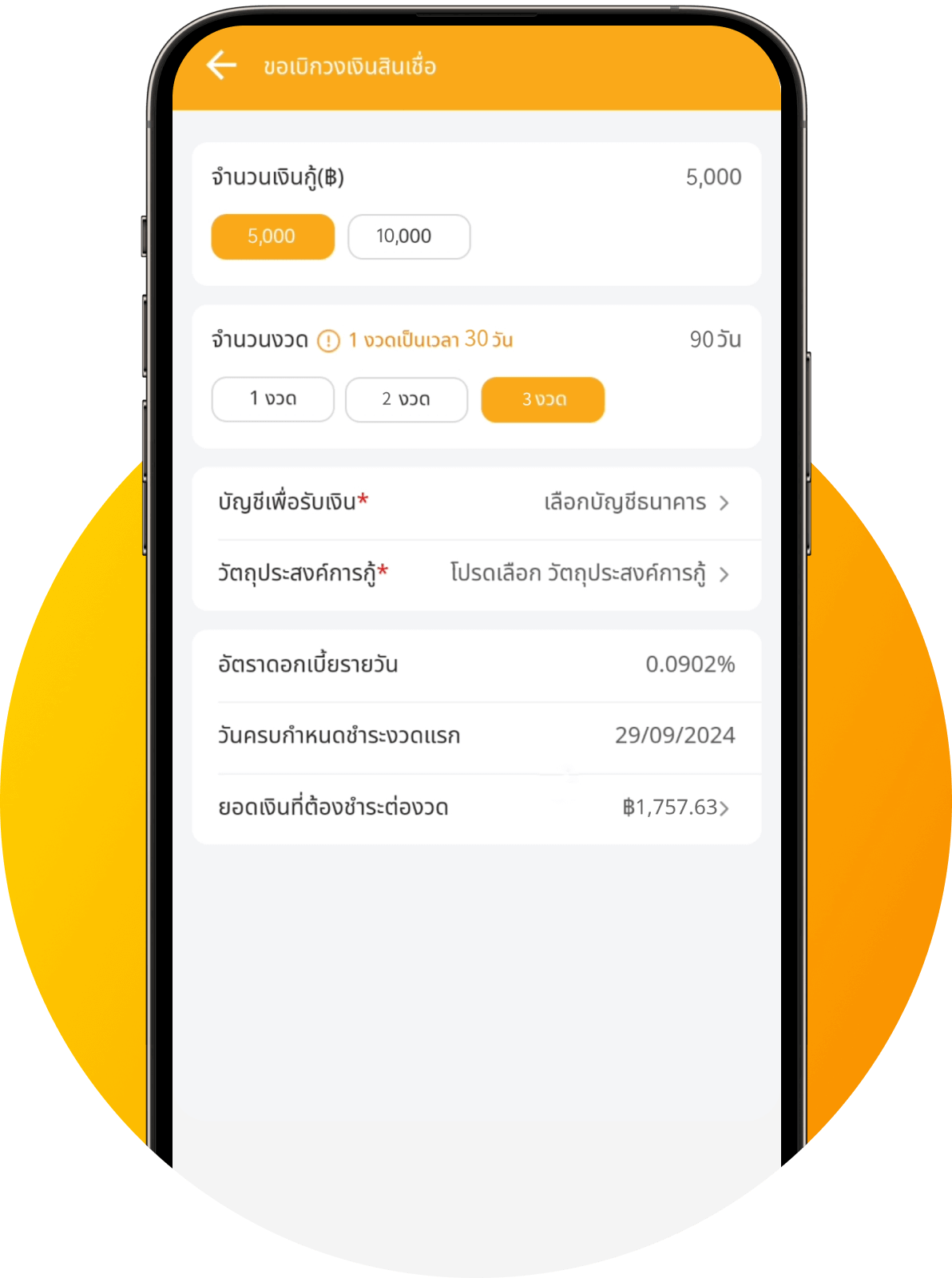

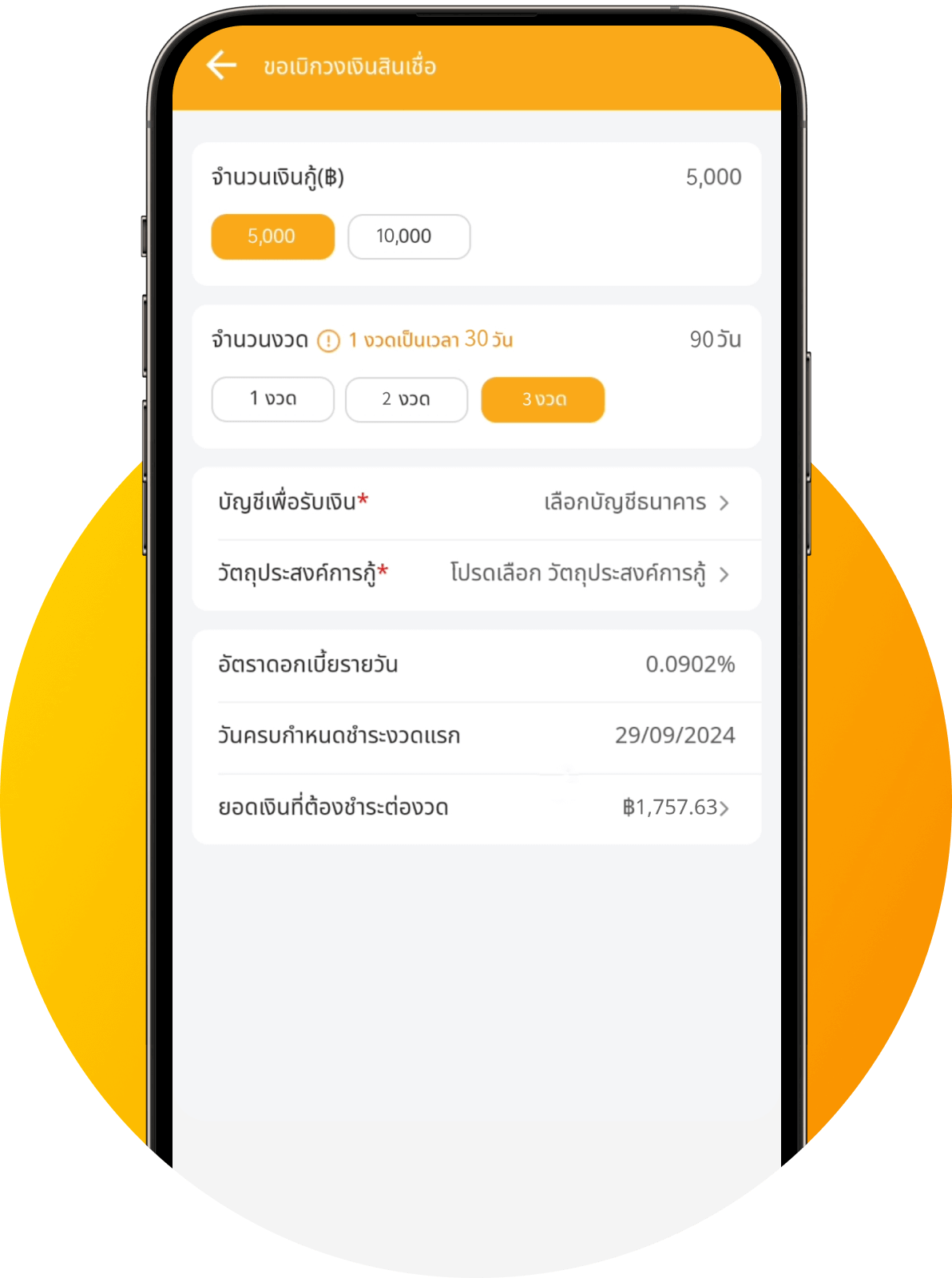

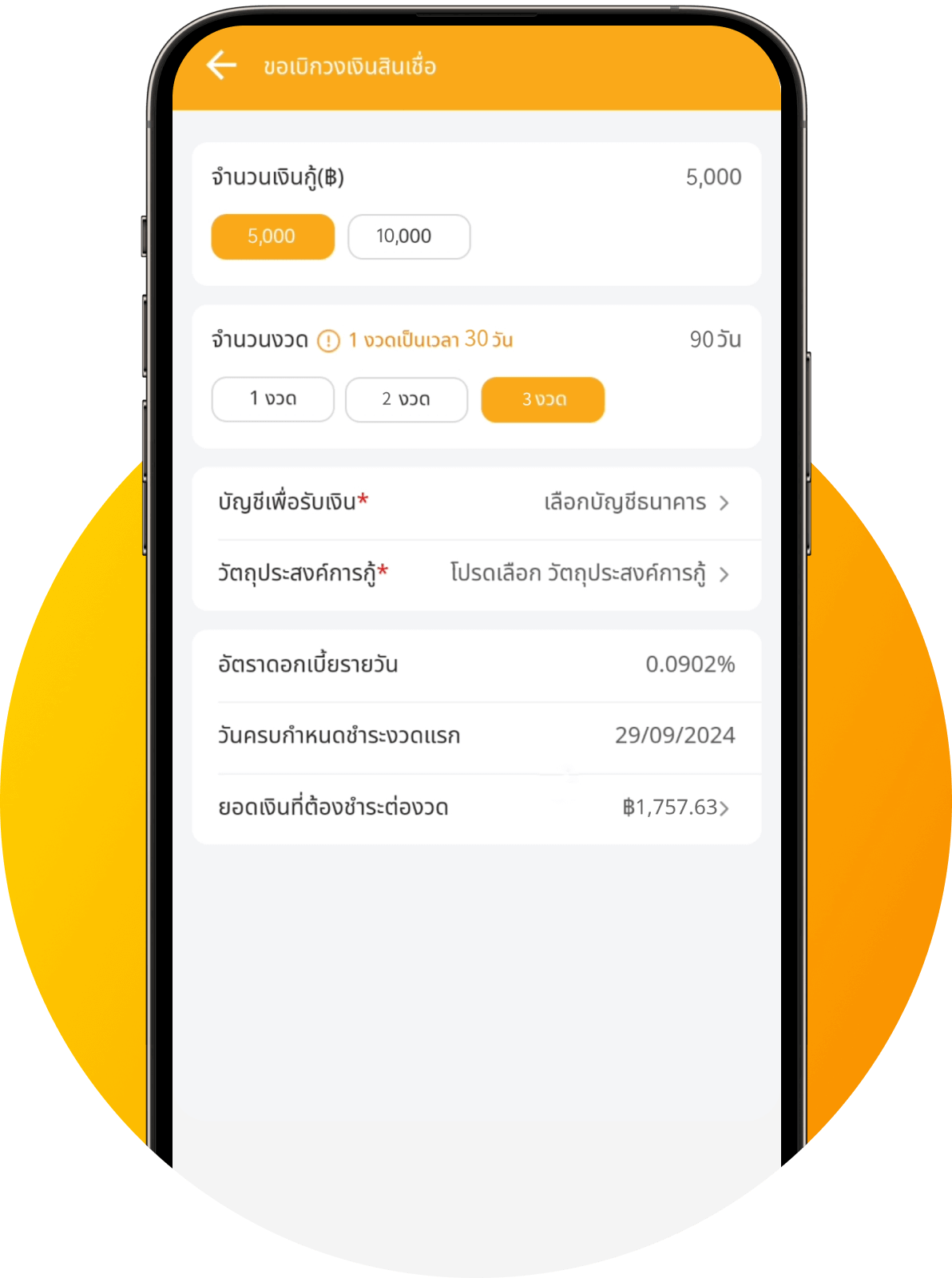

Choose your desired amount and loan terms.

Enter the OTP code to confirm the transaction and the money will be transferred to your registered account.

Enter the Paypaya application to make the payment.

Select a pending amount.

Save QR code for payment on banking applications.

No need to reapply for a new cash credit limit; once the full amount has been paid back, you can withdraw another credit limit immediately.

Follow our LINE Official Account at @paypaya to manage your account.

Enter the Paypaya application and tap “Apply for a credit limit.”

Upload your ID card and fill in your personal information accurately.

Once your application is submitted, you will know the result instantly.

Enter the Paypaya application and tap “Cash Withdrawal.”

Choose your desired amount and loan terms.

Enter the OTP code to confirm the transaction and the money will be transferred to your registered account.

Enter the Paypaya application to make the payment.

Select a pending amount.

Save QR code for payment on banking applications.

No need to reapply for a new cash credit limit; once the full amount has been paid back, you can withdraw another credit limit immediately.

Follow our LINE Official Account at @paypaya to manage your account.